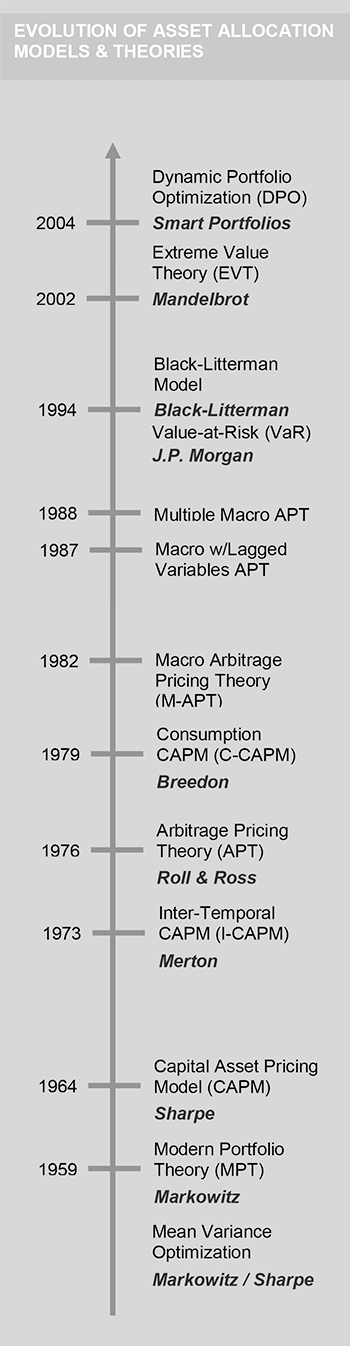

Modern Portfolio Theory, developed by Harry Markowitz during the 1950’s, was the first quantitative approach to asset allocation.

Extreme Value Theory

Since then, the advancements in technology, mathematical algorithms, and experience have led to today’s most advanced portfolio optimization methodology, EVT (Extreme Value Theory). When frequent extreme events keep being described in news reports as “once-in-a-thousand-years”, or “once-in-ten-thousand-years,” common statistical methods and a common understanding of markets seem to be lacking.

EVT not only accepts that extreme events occur; EVT allows their frequency and severity to be modeled and the associated risk to be managed. Fundamentally, traditional models assume that markets are static; EVT begins with the assumption that markets change and that recent market information is more valuable than long-term average data.

Smart PortfoliosTM’ state-of-the art optimization solution using EVT is called Dynamic Portfolio Optimization. DPO replaces traditional asset allocation models with advanced analytics resulting in superior performance and risk management.

Smart Investment Process

Here’s a paradox: The investment management industry acts as if the most frightening decision to make is that assets should sometimes be converted to safe investments in Treasury's and cash equivalents. Is it because a tactical retreat is an admission of fear? Is it to keep that responsibility on the shoulders of the investor? Is it simply because common analytical models are weak?

A second paradox: Although it is the result of complex analysis using state-of-the-art analysis, Smart PortfoliosTM delivers a large part of its value by the simplest asset allocation decision: increase the fraction of the portfolio invested in cash equivalents or Treasury's.

Finally, a third paradox: Although it’s conventional wisdom that an investor needs to accept higher risk to get a higher return, the highest return through a market cycle may be achieved by reducing risk at the right times (when risk is not being adequately compensated).

Risk management is the primary focus of Smart PortfoliosTM and, we believe, the primary way to improve risk-adjusted returns. We use state-of-the-art mathematics to forecast overall market risk as well as the risk and expected returns of our managed portfolios. Smart PortfoliosTM recognizes the trade-off between risk and return. Our strategy allows for the portfolio mix to be adjusted to compensate for the increases or decreases in forecasted risk-adjusted return. Smart PortfoliosTM runs frequent (monthly or more often) diagnostics to measure the change in the portfolio’s risk and return balance. In addition, we schedule quarterly back-testing and stress-testing of the models to identify any need for changes to the portfolio universe and/or to recalibrate the models’ risk metrics.

Smart PortfoliosTM screens a broad range of competing funds in each specified asset class or sector to identify which are best suited for consideration in the asset allocation model. We refer to that narrower range of investment choices, composed of dozens instead of hundreds of potential choices, as the model’s “universe.”

Screening factors include: liquidity, diversity, volatility and expense ratios. In addition to the traditional analytical tools used to analyze securities, Smart PortfoliosTM uses its advanced mathematics to compare funds for historical, current and forecasted risk and return.

Diversification is the secret sauce of investing because it allows the investor to reduce volatility (risk) and create a more consistent stream of returns. The driver behind diversification is the “dependency structure” among securities, most commonly referred to as correlation.

If two securities are highly correlated the reduction of risk achieved by allocating to both of them is minimal because both securities will move in the same direction during up and down markets.

If two securities have low or negative correlation then portfolio volatility is reduced because one security is going up while the other is moving less or in a different direction.

Calculating the dependency has historically been done using “linear correlation,” which is the average relationship between two securities over a defined period of time. Correlation is a poor measurement of dependency because markets are dynamic and prices change daily, as do the risk and return characteristics of individual securities.

The daily change in a security's price alters its relationship with other securities. This calls for a tool that constantly adjusts for those dynamically changing relationships, and that tool or method, called Copula Dependency, is also an integral part of the Dynamic Portfolio OptimizationTM engine.

Evolution Timeline